massachusetts estate tax rates table

If youre responsible for the estate of someone who died you may need to file an estate tax return. No estate tax or inheritance tax.

Income Tax Brackets For 2022 Are Set

The estate tax is a transfer tax on the value of the decedents estate before distribution to any beneficiary.

. An estate valued at exactly 1 million will be taxed on 960000. Thankfully there is no inheritance tax in Connecticut. The estate tax rate for Massachusetts is graduated.

The median property tax in Massachusetts is 351100 per year for a home worth the median value of 33850000. No estate tax or inheritance tax. Property tax rates are also referred to as property mill rates.

Town Residential Commercial Year Abington. Up to 25 cash back In Massachusetts the estate tax rate is based on a historical federal credit for state death taxes. If your taxable estate including any taxable gifts made during your lifetime totals 1 million or more your estate must file a Massachusetts estate tax return and you may owe Massachusetts estate tax.

Map of 2022 Massachusetts Property Tax Rates - Compare lowest and highest MA property taxes for free. Get the inside scoop on what its really like to live in the. The federal estate tax exemption is at a historic high in 2019 of 114 million for individuals 228m for couples.

The Massachusetts Department of Revenue is responsible. The estate tax sometimes also called the death tax is a tax thats levied on the transfer of a deceased persons assets. Tax amount varies by county.

Massachusetts Estate Tax Rates. Massachusetts uses a graduated tax rate which ranges between 08 and a maximum of 16. Suburbs 101 is an insiders guide to suburban Living.

Break that threshold and your heirs are liable at a flat rate of 40 of the amount over the. This means that if your estate is worth 25 million the tax will apply to the entire 25 million not just the 15 million amount that is above the exemption. Additionally because the taxable estate of 5000000 exceeds 1000000 the estate tax due is 391600.

Massachusetts Estate Tax Rates. Estates with a net value of more than this pay an estate tax as high as 16. The Massachusetts State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Massachusetts State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

If youre wondering what is the mill rate or what is the property tax rate in any town in Massachusetts youve come to the right page. Unlike most estate taxes the Massachusetts tax is applied to the entire estate not just any amount that exceeds the exemption threshold. Using the table this tax is calculated as follows.

However the Massachusetts estate tax threshold is considerably lower. Massachusetts Estate Tax Overview. Take a look at the table below.

Starting in 2023 it will be a 12 fixed rate. The 2019 Massachusetts estate tax exemption is 1 million. 104 of home value.

Massachusetts estate tax returns are required if the gross estate plus adjusted taxable gifts computed using the Internal Revenue. However for most individuals who have assets between 1M and 5M then the tax rate hovers anywhere from 0 to 20. The Massachusetts estate tax uses a graduated rate ranging from 08 to 16 percent.

The table below lists all of the rates. If a person is subject to both the Federal and State tax then their marginal estate tax rate could be 45 or more. Counties in Massachusetts collect an average of 104 of a propertys assesed fair market value as property tax per year.

Note that the above estate values are given after administrative and estate expenses. Tax amount varies by county. This is why residents whose estates hover around the 1 million mark have to be especially careful.

To figure out how much your estate will need to pay in estate taxes first find your taxable estate bracket in the chart below. In many cases the capital gain tax rates are higher than the estate. No estate tax or inheritance tax.

Click table headers to sort. Massachusetts has one of the highest average property. Massachusetts estate tax returns are required if the gross estate plus adjusted taxable gifts computed using the Internal Revenue Code in effect on December 31 2000 exceeds 1000000.

402800 55200 5500000-504000046000012 Tax of 458000. Example - 5500000 Taxable Estate - Tax Calc. Even then only the portion of the estate that exceeds 1158 million will be taxed at a maximum rate of 40.

And yes its complicated. In the administration of an estate there are many services that the personal representative formerly. A properly crafted estate plan may.

The estate tax rate is based on the value of the decedents entire taxable estate. For the most up to date tax rates please visit the Commonwealth of Massachusetts. Look up your property tax rate from the table above.

If the estate is worth less than 1000000 you dont need to file a return or pay an estate tax. The top estate tax rate is 16 percent exemption threshold. Rate Threshold 0 40000.

To find out the exact state estate tax owed in 2021 see the Massachusetts Department of Revenues Computation of Maximum Federal Credit for State Death Taxes. If the estate is worth less than 1000000 you dont need to file a return or pay an estate tax. This tool is provided to help estimate potential estate taxes and should not be relied upon without the assistance of a qualified estate tax professional.

This means if the value of an estate exceeds the 1 million threshold anything above 40000 will be taxed. Poor planning can tip the estate over that threshold and result in a huge tax bill. Counties in Massachusetts collect an average of 104 of a propertys assesed fair market value as property tax per year.

Note this calculator is for estimation purposes only. A Massachusetts estate tax return Form M-706 is required to be filed because the decedents estate exceeds the filing threshold. The graduated tax rates are capped at 16.

Thoughtful estate planning is very important especially for those that wish to leave assets to their beneficiaries or heirs without being impacted by significant taxes. The total Massachusetts estate tax due on his estate would be 280400 or 238800 41600 104 of 400000 the amount of the estate over 3540000. 104 of home value.

This increases to 3 million in 2020 Mississippi. Longmeadow has the highest property tax rate in Massachusetts with a property tax rate of 2464. Unless specifically stated this calculator does not estimate separate estate or inheritance taxes which are levied in many states.

For your reference I provided the 2016 Massachusetts Property Tax Rates By Town in the table below. If you were to translate the amount owed into a tax rate. The 2020 federal estate tax exemption threshold is 1158 million which means that the estate of an individual who dies in 2020 will only owe estate taxes if its value is greater than that threshold.

The Massachusetts Estate Tax applies to individuals with assets worth over 1 Million and the tax rate varies. Your estate will only attract the 0 tax rate if its valued at 40000 and below. An estate valued at 1 million will pay about 36500.

The tax rate ranges from 116 to 12 for 2022. The rate for residential and commercial property is based on the dollar amount per every 1000 in assessed value. The median property tax in Massachusetts is 351100 per year for a home worth the median value of 33850000.

In 2022 the federal estate tax. 5000000 - 60000 4940000. The top estate tax rate is 16 percent exemption threshold.

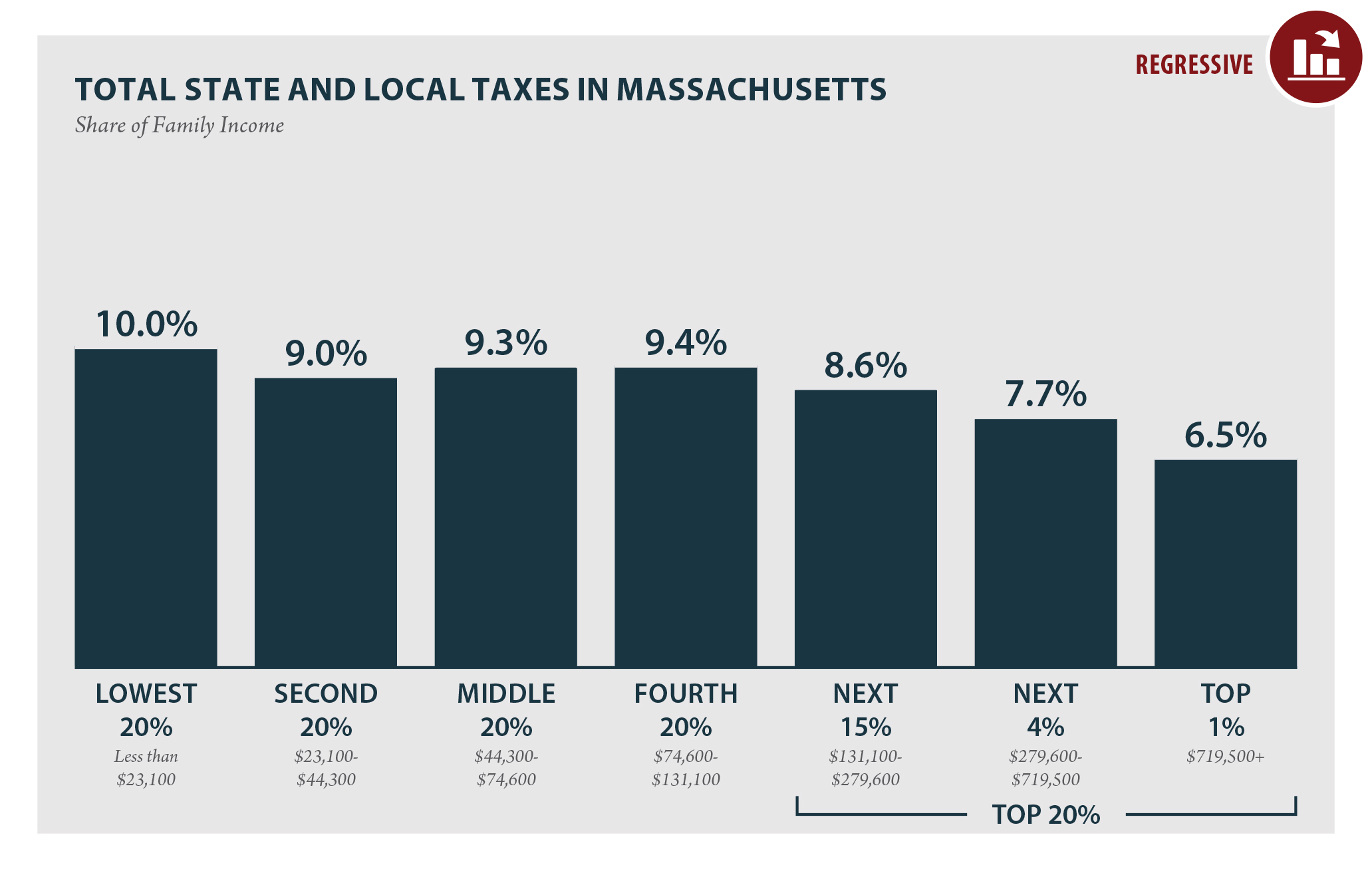

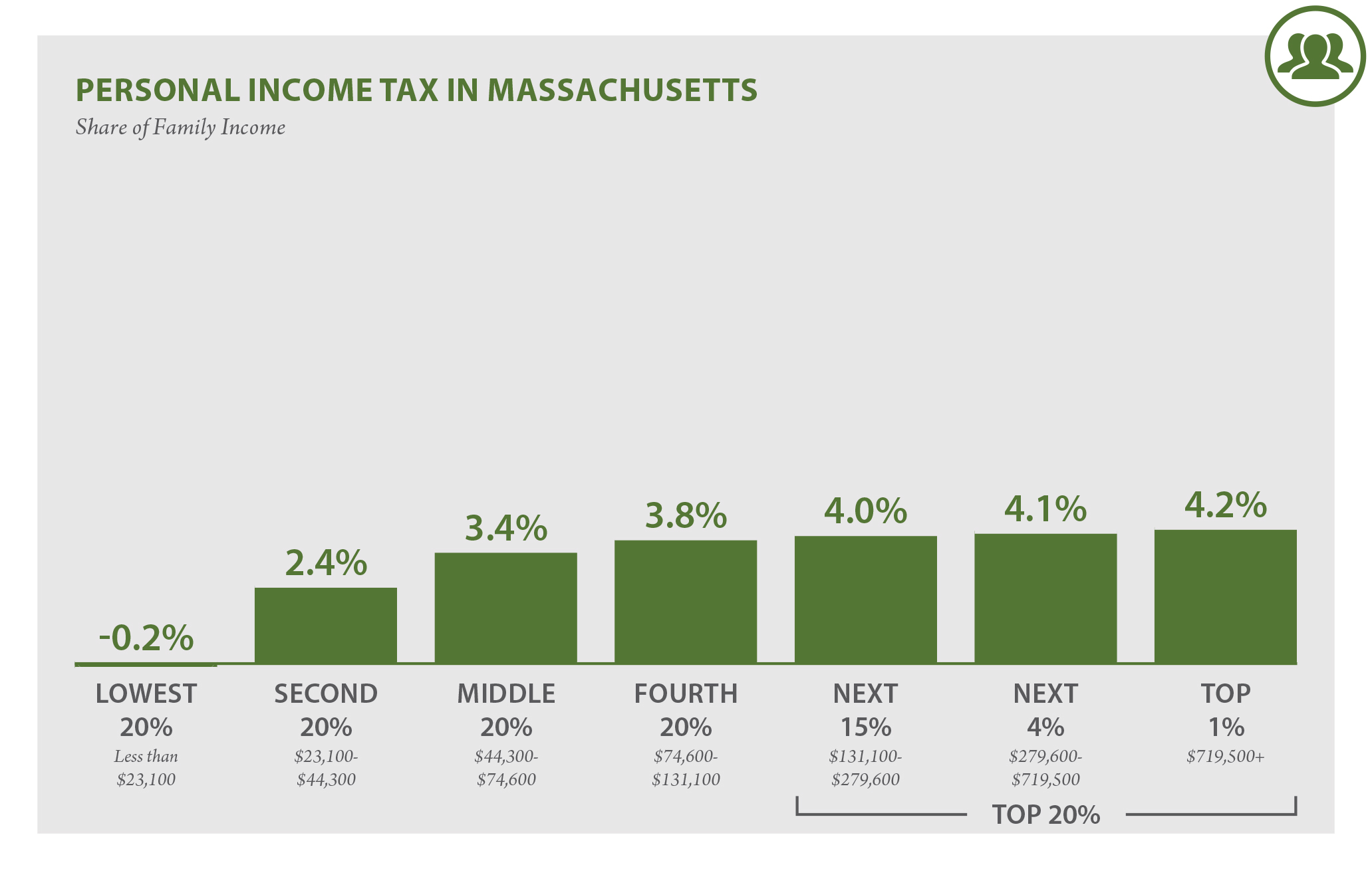

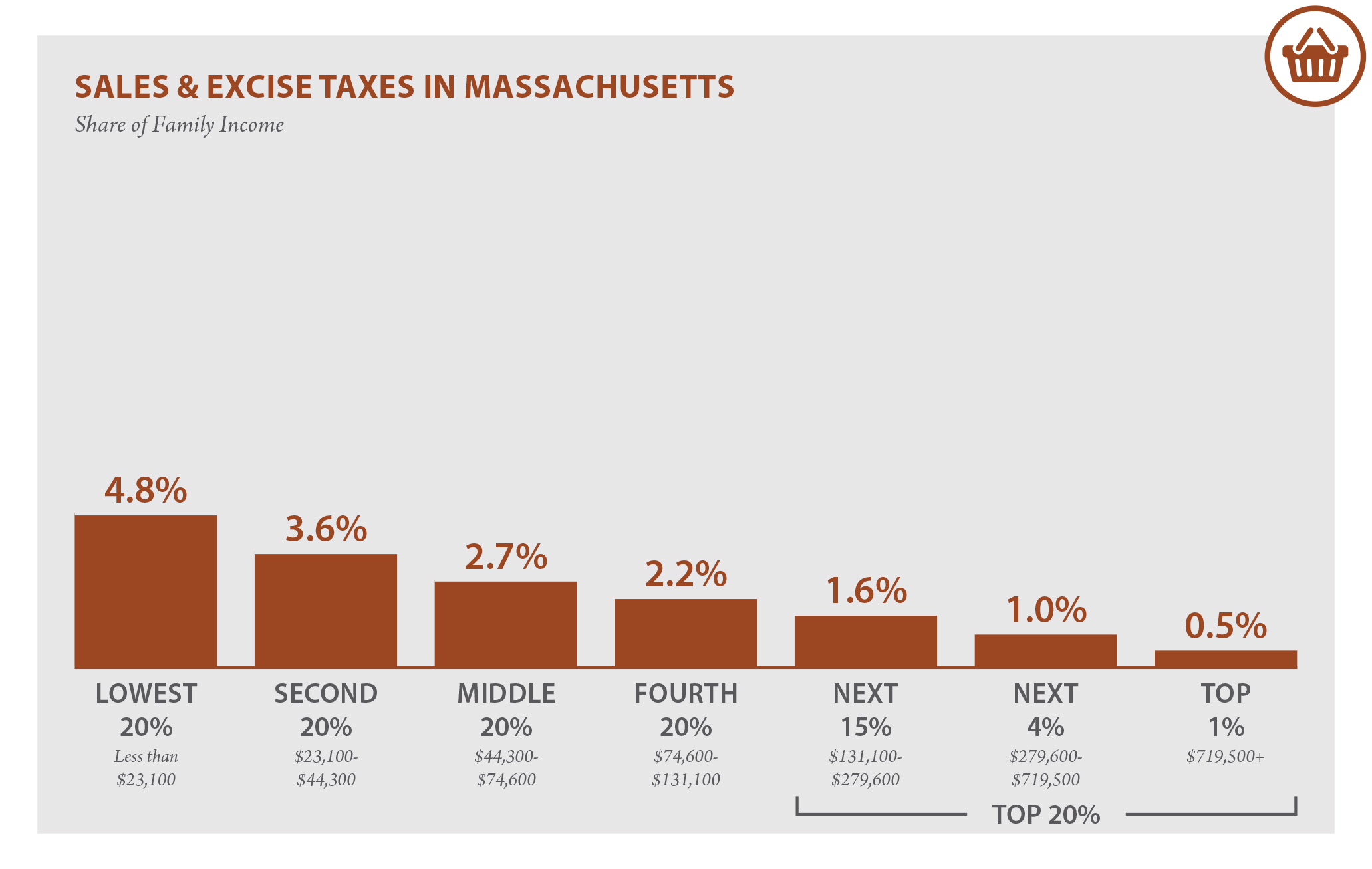

Massachusetts Who Pays 6th Edition Itep

State Corporate Income Tax Rates And Brackets Tax Foundation

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

2022 Tax Inflation Adjustments Released By Irs

Massachusetts Estate Tax Everything You Need To Know Smartasset

Income Tax Brackets For 2022 Are Set

Massachusetts Who Pays 6th Edition Itep

A Guide To Estate Taxes Mass Gov

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Massachusetts Estate Tax Everything You Need To Know Smartasset

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

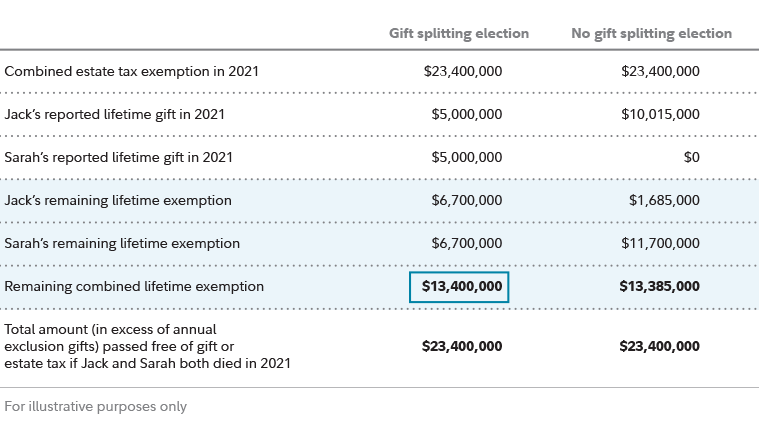

Estate Planning Strategies For Gift Splitting Fidelity

Massachusetts Who Pays 6th Edition Itep

Massachusetts Estate Tax Everything You Need To Know Smartasset

How Do State And Local Individual Income Taxes Work Tax Policy Center